What is the Solar Investment Tax Credit?

Since 2006, the United States government has offered Investment Tax Credits (ITC) to the owners of solar programs. At the time of this writing (in Q1 of 2026) the ITC is valued at 30% of the eligible cost of a solar program. So, for every $1 Million in eligible costs, the owner of the solar program receives an Investment Tax Credit valued at $300,000.

The Investment Tax Credit is made available to the solar program owner shortly after a solar program is placed in service, and a program must operate for at least five years to remain eligible for the credit.

How are Investment Tax Credits Monetized?

For solar program owners who have a large tax liability, an Investment Tax Credit can be applied dollar-for-dollar against taxes due.

For owners that do not have significant tax liability, tax credits can be made available to a third party through two different means. The most common is to transfer the credits, typically at a value slightly below par, on the ITC Direct Transfer market. Alternatively, a third party can make a tax equity investment into a solar program, allowing the third party to receive the benefit of the ITC.

Regardless of approach, the ITC has served as a way to decrease the deployment costs of solar programs since it provides an immediate financial benefit shortly after a solar program goes live.

Why are Investment Tax Credits Going Away?

The federal government discontinued Investment Tax Credits for commercial solar programs in the One Big Beautiful Budget Bill (OBBB) that was passed on July 4, 2025.

What are the Deadlines for Preserving ITC?

The OBBB provided two paths for maintaining Investment Tax Credits on solar programs at commercial properties:

- Project must be ‘In Construction’ by July 4, 2026 (the one year anniversary of the OBBB) OR

- Project must be Placed in Service (ie, live) by December 31, 2027

A project that meets either of these two criteria will still be eligible for ITC. If neither criteria is met, then ITC will not be applicable.

What Is The Best Way to Preserve the ITC?

The deployment timeframe of commercial solar programs can be highly variable, as it may be dependent on utility interconnection approvals, state community solar program acceptance and utility inspections and site reviews. Therefore, it may be difficult to rely on a project being live by December 31, 2027.

Therefore, the most reliable way to ensure that a project is eligible for ITC is to confirm that the project is In Construction by July 4, 2026.

A project that reaches the In Construction state is considered to have its Investment Tax Credits ‘safe harbored’. This means that if the project goes live within four years of being safe harbored it will still be eligible to receive the benefit of the ITC.

Criteria For Reaching ‘In Construction’ Status

The federal government has released clear guidance on the criteria that needs to be met in order for a project to be considered to be ‘in construction’ under the ITC safe harboring guidelines.

- For projects smaller than 1.5 MWac: At least 5% of the total project spend must be made, and documented, prior to July 4, 2026

- For projects greater than 1.5 MWac: Project must pass the ‘Physical Work Test’, meaning that physical work of a significant nature must begin and be ongoing.

From there, continuous construction and progress needs to be made to show progress towards reaching Commercial Operation.

We Are Already in 2026: What Do We Do?

For most commercial solar projects, the utility interconnection and community solar application processes can take 6 to 18 months. Given that we are now in 2026, it is no longer feasible to expect that a project will be through these application processes by July 4, 2026 if these application processes are not already underway.

To solve this predicament, King Energy will allocate project capital to a set of strategic projects in May 2026, allowing each project to exceed the 5% spend criteria to be safe harbored.

To be considered for this process, a project must meet the following timing criteria:

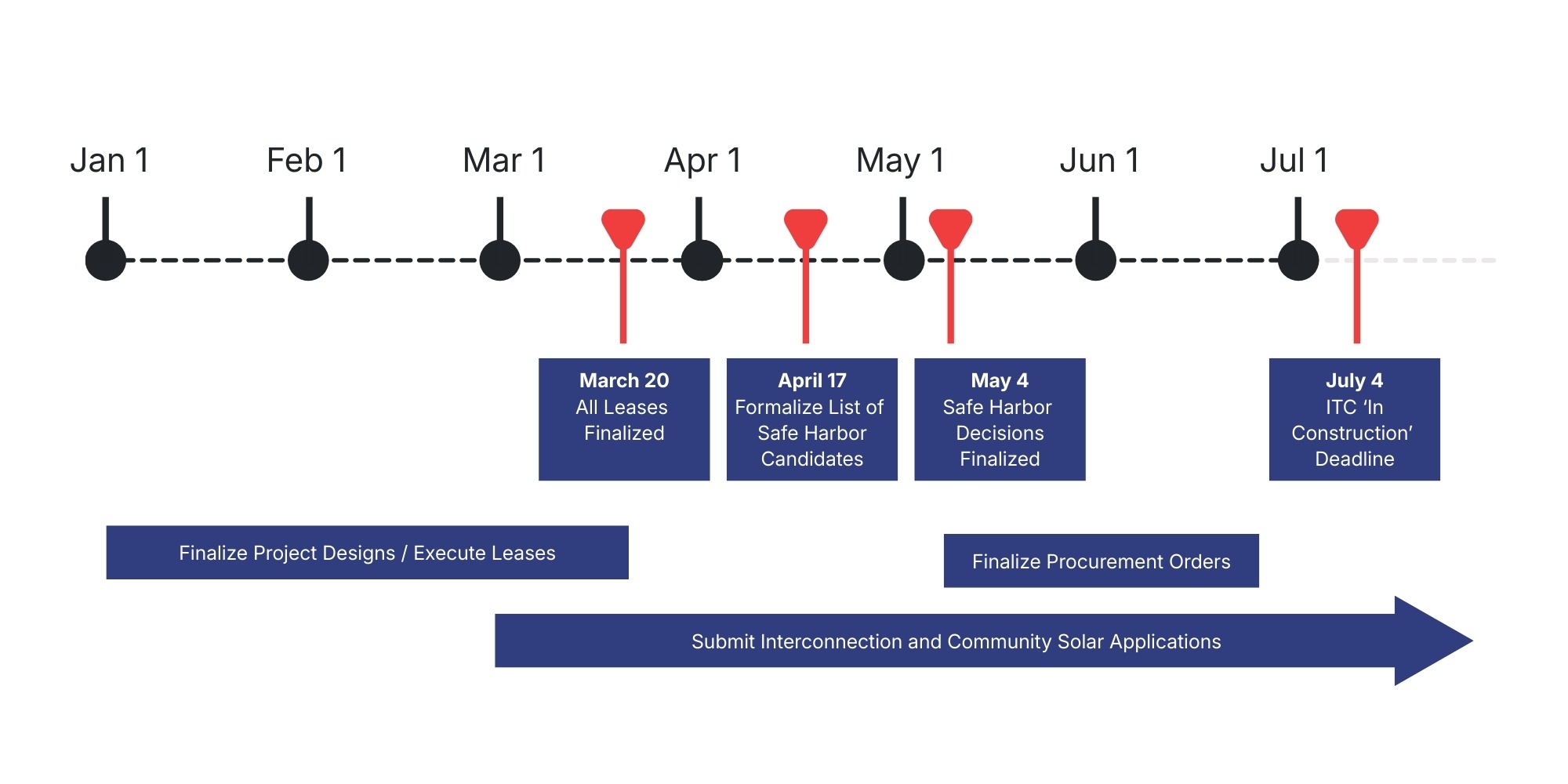

- Deadline for lease execution: Friday, March 20, 2026

- Deadline for interconnection and community solar application submission: Friday, April 3, 2026

- Deadline for property owner to release any open lease contingencies: Friday, April 17, 2026

- Selection of safe harbor candidates: Friday, April 17, 2026

- Finalization of safe harbor investments: Monday, May 4, 2026

Procurement orders will then be placed in the second half of May for all projects, allowing appropriate purchases, with accompanying documentation, to be completed in June.

Can My Property Be Considered For This Safe Harboring Process?

Given that the presence of the ITC allows materially higher rent to be paid on rooftop solar leases, King Energy has allocated a significant amount of capital to making safe harbor investments before the July 4, 2026 deadline.

If you have a property that you would like King Energy to consider, please contact the King Energy team as soon as possible so we can evaluate the property and determine if it is possible to put a lease agreement in place by March 20, 2026.

Selecting The Right Solar Partner

With the upcoming changes to solar Investment Tax Credits, and other incentives, we believe it is important to select a solar partner that is prepared to be a long-term partner and who has the financial backing to thrive through the evolution and change that the solar industry is undergoing.

King Energy is backed by over $250 Million in secured project financing and has allocated substantial financing to support the safe harboring of projects leading into the ITC safe harboring deadlines. Additionally, King Energy has deep experience working with national and regional property ownership firms, serving as a trusted advisor who actively supports the long-term financial success of solar programs at commercial properties.

To learn more about ways to secure a solar lease at a commercial property ahead of the Investment Tax Credit safe harboring deadlines, please reach out to us at info@kingenergy.com.