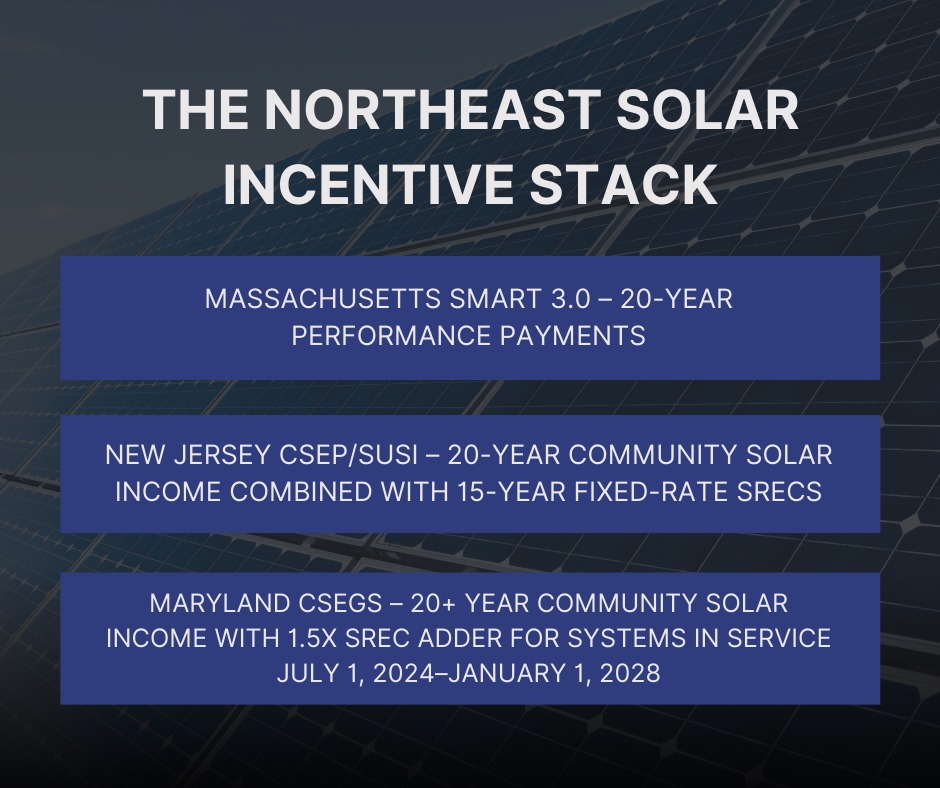

Across Massachusetts, New Jersey, and Maryland, commercial solar incentives in 2025 are at their most advantageous point yet. Federal Investment Tax Credits (ITCs) remain available for projects that begin construction by mid-2026 or go live before the end of 2027. For property owners considering new solar installations, combining these federal incentives with state-level programs in Massachusetts, New Jersey, and Maryland creates an unmatched opportunity to maximize financial return and long-term NOI growth.

By partnering with a commercial solar developer, property owners can increase net operating income (NOI), reduce risk, and make long-term financial sense.

Why Commercial Solar Incentives Matter for CRE Portfolios

For commercial property owners, solar has evolved from an ESG initiative into a core revenue strategy. Solar partners, who rent open roof space, will turn solar incentives such as production-based payments, cash rebates, and renewable-energy credits into rent payments that directly strengthen property income without adding CapEx. King Energy is the nationwide leader in multi-tenant commercial solar, with more than 200 active systems and over $110 million in added property value since 2021. Our enterprise-grade OneBill™ software, end-to-end management, and deep regional experience make incentive navigation simple, efficient, and financially sound.

Massachusetts Commercial Solar Incentives

Massachusetts offers substantial state incentives for commercial solar, enabling property owners to generate steady income and long-term value through the SMART 3.0 program.

Massachusetts SMART Program Details

The SMART Program is a production-based incentive managed by the Massachusetts Department of Energy Resources (DOER) in partnership with approved investor-owned utilities. Designed to replace the earlier SREC program, SMART was created to bring more predictability and long-term planning capability to commercial solar development across the state.

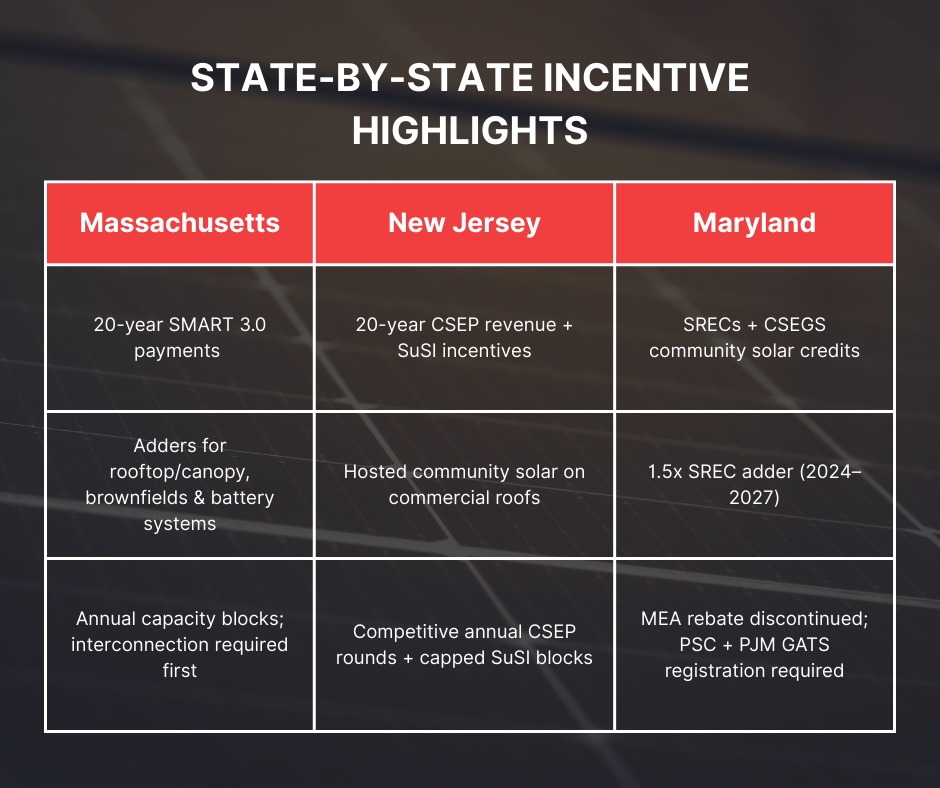

Under the latest SMART 3.0 regulations, capacity is allocated annually and compensation rates and “adders” are adjusted based on project size, location, and type. For commercial arrays on roofs or parking lots, incentive payments extend over a 20-year term and are directly tied to energy production.

Commercial Solar Benefits in Massachusetts

SMART allows commercial property owners to convert solar output into a consistent, tariff-based income stream that strengthens long-term financial performance.

- Provides a steady 20-year revenue stream from solar generation, improving predictability for asset owners.

- Offers “adders” (premium compensation) for rooftop or canopy installations, brownfields, and systems paired with batteries to optimize returns.

- Enables owners to rent roof space rather than invest upfront — turning an unused surface into additional income while leveraging tenant or grid demand.

- When stacked with the federal ITC and other state incentives, the economics become especially compelling for commercial portfolios.

Eligibility & Timing

Commercial property owners hoping to participate in the SMART 3.0 program should focus on two key timing factors.

- Solar programs must be through the utility interconnection application process before they can apply to the SMART program.

- The program has a fixed amount of annual capacity, so there are benefits to having applications ready to go at the opening of each annual application window.

Planning and applying early helps projects secure participation in the program.

New Jersey Commercial Solar Programs 2025

New Jersey remains one of the most active commercial solar markets in the country, driven by strong policy support and robust state-level incentive structures. Current programs provide predictable revenue and long-term value creation through hosted rooftop systems.

Community Solar Energy Program (CSEP) and SuSI Overview

The Community Solar Energy Program (CSEP) serves as New Jersey’s flagship model for shared solar access. It enables commercial roofs to host systems that deliver energy to on-site tenants and local community subscribers, who receive bill credits for their share of generation. In return, property owners earn lease or rent income, transforming unused roof space into a stable revenue source. The program’s latest expansion, announced in August 2025, increased available capacity and prioritized multi-tenant commercial participation.

For projects outside the CSEP framework, the Successor Solar Incentive (SuSI) program provides fixed, long-term incentive payments based on actual energy production. Under SuSI’s Administratively Determined Incentive (ADI) pathway, most commercial rooftop projects receive a set incentive rate per MWh for 15 years, ensuring predictable returns over the system’s life.

Commercial Solar Benefits in New Jersey

CSEP elevates commercial roofs as a cornerstone of New Jersey’s clean-energy growth, allowing property owners to generate new rental income while supporting lower-cost power for tenants and surrounding communities. These projects often strengthen ESG performance and community engagement without direct capital outlay. SuSI complements this model with consistent production-based payments for qualifying systems, extending financial stability beyond CSEP participation.

Eligibility & Timing

CSEP projects are selected through annual competitive application rounds managed by the New Jersey Board of Public Utilities. Scoring emphasizes equity, environmental benefit, and subscriber diversity. Because capacity allocations can fill quickly, early coordination with experienced partners remains key.

SuSI categories also operate under annual capacity limits, and incentive levels may change each program year, making early planning essential to securing the most favorable terms.

Maryland Commercial Solar Energy Generation Systems (CSEGS) Program

Maryland’s commercial solar incentives provide ongoing credit revenue to lower costs and reward sustained energy production.

Maryland Community Solar and SREC Programs

The Maryland CSEGS program provides the ability for community solar programs to be deployed in the areas of Maryland served by the four largest investor-owned utilities.

Additionally, Maryland’s Solar Renewable Energy Credits (SRECs) create ongoing value for every megawatt-hour produced. Each SREC represents 1 MWh of verified generation and can be sold through the PJM Interconnection’s Generator Attribute Tracking System (GATS) to utilities seeking to meet state renewable-energy requirements. Credits are valid for three years, and revenue depends on market demand and trading prices.

Through the Brighter Act Tomorrow, Maryland currently has a 1.5 adder to their SRECs for systems that are placed into service July 1, 2024- December 31, 2027.

Commercial Solar Benefits in Maryland

Maryland’s commercial solar programs give property owners a dual path to financial gain – immediate savings from rebates and recurring income from solar energy production.

- Reduce upfront costs through direct MEA rebates, lowering the barrier to solar adoption and improving project ROI from day one.

- Generate predictable revenue through SRECs, which reward every megawatt-hour produced with tradable credits.

- Strengthen long-term NOI by stacking rebate savings, SREC income, and the federal ITC for a diversified return profile that helps offset rising utility costs.

Eligibility & Timing

MEA rebate funding operates on a first-come, first-served basis each fiscal year through a competitive application process. To participate in the SREC program, property owners must obtain certification from the Maryland Public Service Commission after interconnection, then register in PJM GATS within 30 days. Early registration and coordination with qualified partners ensure eligibility under current credit rates and state compliance rules.

How to Evaluate Incentive Opportunities Across a Portfolio

For commercial portfolios, the value of solar often depends on where and when projects are executed. Incentive timelines, capacity limits, and regulatory changes can impact returns by state, making portfolio-level analysis essential for capturing the highest ROI. A holistic strategy aligns cash-flow priorities and multi-property ESG targets.

- Review portfolio locations to identify where state and federal incentives combine for the strongest financial outcome.

- Compare application timelines and capacity block status between states to determine project sequencing.

- Integrate building capital plans and rent terms when scheduling installations.

- Model portfolio-wide scenarios to align solar adoption with ESG commitments and financial goals.

King Energy’s enterprise-grade software and program expertise simplify this analysis, giving owners a comprehensive view of available incentives, potential returns, and timelines across every commercial property in their portfolio.

Why a State-Specific Strategy with King Energy Makes Sense

Navigating multiple state and utility incentive programs requires a partner with both regional experience and national scale. King Energy combines local expertise with enterprise-level execution to help property owners secure the most substantial returns and maintain long-term performance.

Incentive applications move efficiently because King Energy coordinates directly with decision-making bodies and manages every compliance step through a centralized software platform. The result is clear oversight and timely approvals without adding operational burden for property owners.

With active projects in 11 states and more than 200 solar programs, King Energy delivers measurable results, demonstrating proven financial stability and sustained value for commercial portfolios nationwide.

Leverage State Incentives for Lasting Returns

Massachusetts, New Jersey, and Maryland each offer strong opportunities for commercial solar growth backed by proven state programs. Favorable policies, expanding capacity, and long-term revenue potential make now an ideal time to act.

Secure your position in the Northeast’s growing solar market.