The Department of Energy recently released guidance on eligibility for a 10% Investment Tax Credit (ITC) adder for geographies that qualify as Energy Communities.

This Energy Community benefit is one of three potential adders that were included in the 2022 Inflation Reduction Act, each of which offer an additional 10 percentage points of benefit (on top of the 30% ITC provided for in the Inflation Reduction Act).

In practice, this means that a solar program that has $1,000,000 in eligible construction costs would receive an Investment Tax Credit benefit of $400,000 if it is located in an Energy Community (if this were the only adder applied), instead of the standard benefit of $300,000.

Investment Tax Credits are financial incentives provided by the US Government to encourage and promote the adoption of solar energy systems. These tax credits are designed to offset a portion of the cost of installing eligible solar energy equipment, making solar energy more financially viable for businesses and individuals.

Eligible Locations

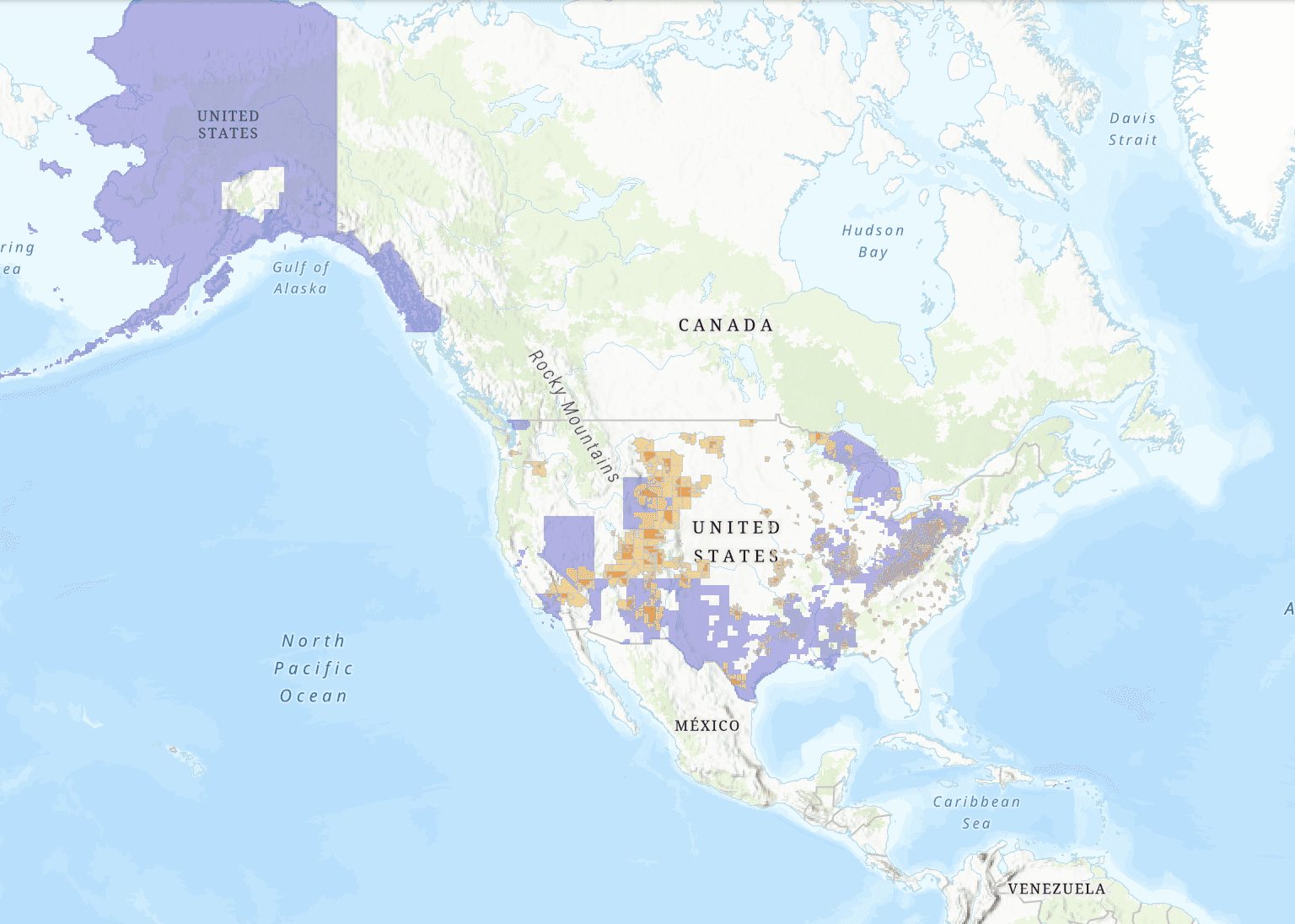

The Department of Energy has shared the following map to determine geographic eligibility for the Energy Community ITC adder:

In California, locations in the following seven counties are currently eligible:

- Kern County

- Los Angeles County

- Orange County

- Solano County

- Sutter County

- Ventura County

- Yuba County

This makes solar installations in these counties eligible for the adder, which creates an exciting opportunity for property owners and businesses in California.

Benefits of the Adder

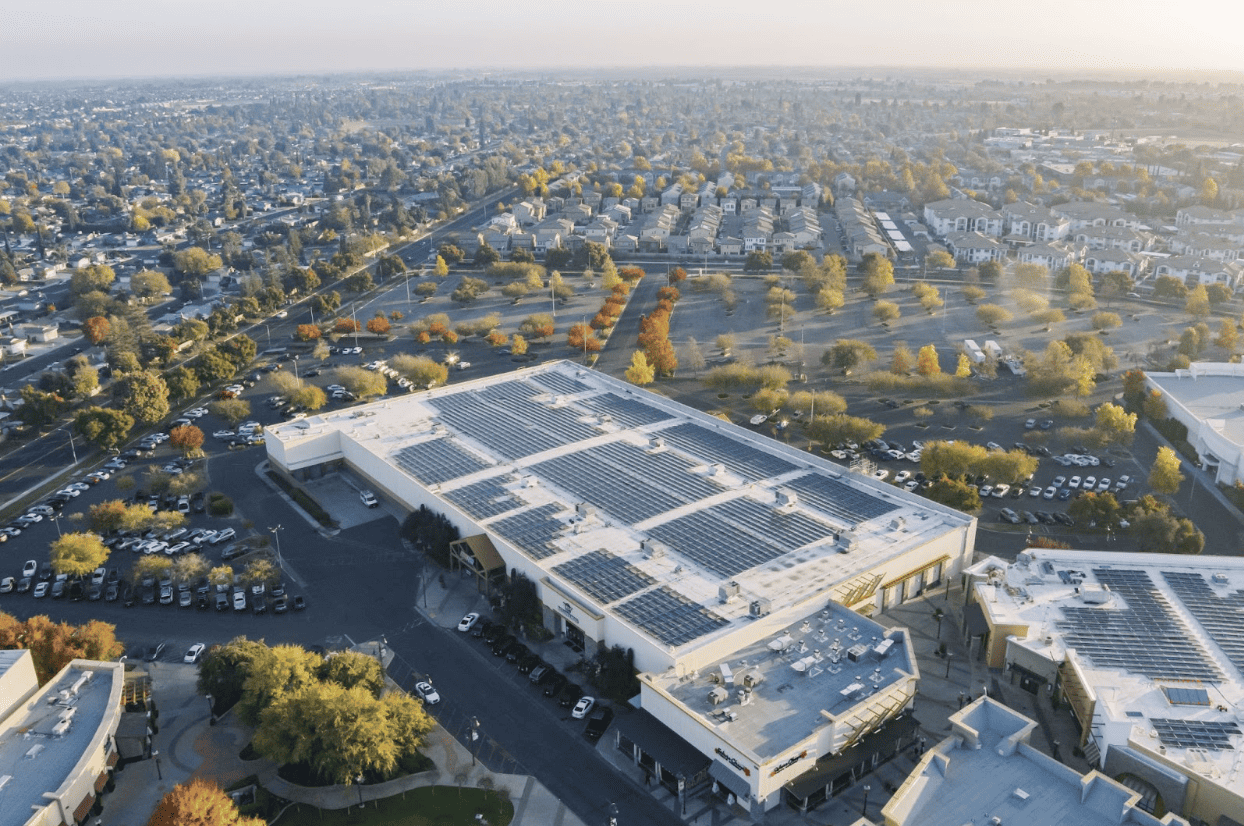

ITC plays an important role in advancing solar energy adoption by providing financial incentives that reduce the upfront costs of solar installations. The ITC Adder for Energy Communities targets key geographies across the United States where it is particularly relevant to speed the adoption of renewables.

ITC plays an important role in advancing solar energy adoption by providing financial incentives that reduce the upfront costs of solar installations.

The intention of the ITC adder is to speed the adoption of renewable energy in communities that have traditionally had jobs generated through traditional energy production sources. Creating jobs in solar installation generates local opportunities for economic growth.

From the perspective of property owners and solar investors, locations that reside within Energy Communities will realize improved economics for their solar programs. For investors, this results in lower net investment costs. For property owners, the ITC benefit translates into higher rents paid for roof space.